Welcome to Magnetic Capital Group.

We make investing safer, simpler and more predictable so you can get there sooner.

Private mortgages with Magnetic check all the boxes of an ideal investment.

Earn consistent, fixed annual returns without the high costs of an advisor and enjoy the peace of mind that comes with knowing every dollar you invest is secured by more than a dollar of marketable Canadian real estate.

Better Security.

No less than $1.25 of highly marketable, residential real estate in Canada to secure every $1.00 you invest.

Predictable Returns.

8-10% fixed annual returns paid by direct deposit to the bank account of your choice on the 15th of every month.

All Inclusive, no fee Services.

We’ll source, vette and manage each investment for you. You'll pay no management fees ever.

Gambling is exciting. Investing shouldn’t be. Private mortgages with Magnetic will be the most boring investment in your portfolio. They’ll also be the one you count on the most.

Invest in your education first and enjoy lasting peace of mind.

Get all your questions answered before you decide if PMI’s are for you. here’s how to do it quickly.

It’s easy to get started investing in private mortgages with Magnetic.

See More >

STEP 1

Book a FREE consultation to get your questions answered by a licensed private mortgage expert.

STEP 2

Get exclusive, complimentary access to our private mortgage investing mastery orientation program.

STEP 3

Onboard with Magnetic in minutes as an approved Investor in compliance with federal legislation and provincial regulations and place your first order.

Introducing the Magnetic Minute

Master the fundamentals of private mortgage investing by following the personal blog of Magnetic founder and nationally recognized financial literacy leader Chris Nichilo.

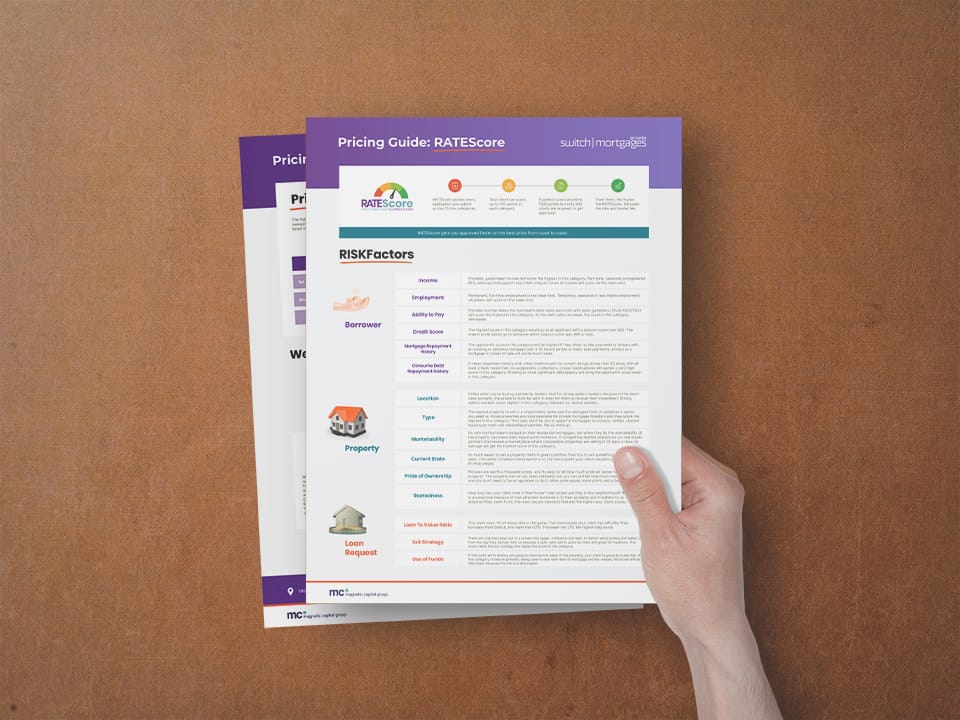

Introducing RATEScore – How we Identify the Highest Quality Private Mortgages for you to Invest in.

RATEScore is Canada’s most sophisticated standardized underwriting scoring and pricing…

How do you lose money investing in a private mortgage?

The beauty of investing in private mortgages is that every…

What is a Mortgage Administrator and What is the Value in Using One?

Magnetic Capital Group is Canada’s premier private mortgage investment administrator.…